Key SaaS Stats and Facts

- The SaaS industry is projected to reach a market volume of $344 billion by 2027.

- By the end of 2024, 99% of companies are expected to use at least one SaaS solution.

- Over 80% of businesses currently use at least one SaaS application.

- SaaS startups received more than $30 billion in venture capital funding in 2022.

- 70% of Chief Information Officers (CIOs) prefer SaaS for its agility and scalability.

- The average customer churn rate for SaaS companies is approximately 5%.

In today’s digital landscape, the Software-as-a-Service (SaaS) sector is experiencing significant growth and transformation. SaaS offers a broad range of solutions, from tools that boost productivity and facilitate communication and collaboration, to advanced customer support systems, engagement platforms, and robust data analytics. As SaaS continues to evolve, it is poised to address the complexities of the digital era and expand into new and innovative areas in the near future.

The concept of Software-as-a-Service has its roots in the 1960s, but it was the advent of cloud computing that truly propelled the SaaS market forward. This shift in how businesses and individuals access and use essential tools has led to a dramatic change in consumer behavior, with SaaS rapidly surpassing traditional software in popularity and usage.

As we look towards 2024, the SaaS industry is set to see groundbreaking advancements. Our team of SaaS experts has examined the latest trends, statistics, and insights to help you stay ahead. Discover how SaaS solutions can transform your business and what to expect in the upcoming year.

SaaS Industry Growth

Statista reports that the projected global revenue for SaaS in 2023 is anticipated to reach $253.90 billion, with an annual growth rate of 7.89%, highlighting the industry’s rapid expansion. But what other growth trends should SaaS providers and users be aware of? Let’s delve into the latest statistics and trends shaping the SaaS landscape now and in the future.

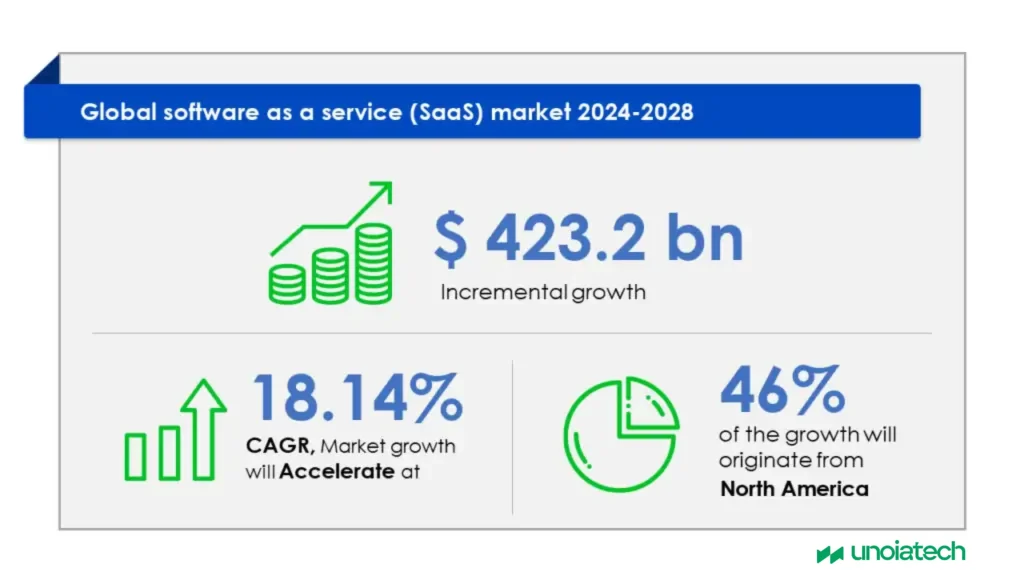

Looking ahead to 2024, the SaaS sector is expected to have a standout year, with projections indicating a market volume of $423.2 billion by 2028. This equates to an average spend per employee of $72.94 in 2023, a figure expected to rise substantially over the next five years. Since 2018, the SaaS industry has outpaced expectations with an impressive 18.7% annual revenue growth. Unsurprisingly, the U.S. dominates the SaaS market with approximately $135 billion in revenue for 2023. Meanwhile, regions such as Europe and Australia are projected to grow at 5% annually, while Asia and Africa are anticipated to see growth rates exceeding 10%. The U.S. leads globally with about 17,000 SaaS companies, followed by the UK, Canada, Germany, and France.

Looking ahead to 2024, the SaaS sector is expected to have a standout year, with projections indicating a market volume of $423.2 billion by 2028. This equates to an average spend per employee of $72.94 in 2023, a figure expected to rise substantially over the next five years. Since 2018, the SaaS industry has outpaced expectations with an impressive 18.7% annual revenue growth. Unsurprisingly, the U.S. dominates the SaaS market with approximately $135 billion in revenue for 2023. Meanwhile, regions such as Europe and Australia are projected to grow at 5% annually, while Asia and Africa are anticipated to see growth rates exceeding 10%. The U.S. leads globally with about 17,000 SaaS companies, followed by the UK, Canada, Germany, and France.

- 2024 is set to be a significant year for SaaS, with the market expected to hit $344 billion by 2027. The average spend per employee is projected to rise from $72.94 in 2023.

- Since 2018, the SaaS industry has experienced remarkable growth, with an annual revenue increase of 18.7%.

- The U.S. leads the SaaS market with around $135 billion in revenue in 2023, with Europe and Australia expected to grow at 5% annually, and Asia and Africa at over 10%.

- The U.S. is home to approximately 17,000 SaaS companies, followed by the UK, Canada, Germany, and France.

Currently, Microsoft commands a substantial 10% of the global SaaS market share, with other major tech players such as IBM, Salesforce, Oracle, Adobe, and Google also holding significant positions. SaaS adoption is expected to surge in the banking, financial, and insurance sectors, growing from $54 billion in 2022 to over $130 billion by 2027. Similarly, the retail and ecommerce SaaS market is forecasted to expand from $48.1 billion to $138.9 billion in the same period. By the end of 2023, up to 99% of companies are expected to use at least one SaaS solution, driven by factors such as cost efficiency, scalability, accessibility, rapid innovation, easy integration, and a focus on customer experience. As the industry evolves, SaaS companies face challenges like data security, service reliability, customer retention, IT integration, adapting to customer needs, and regulatory compliance.

- Microsoft holds 10% of the global SaaS market share, with other tech giants such as IBM, Salesforce, Oracle, Adobe, and Google following closely.

- SaaS adoption in the banking, financial, and insurance sectors is predicted to grow from $54 billion in 2022 to over $130 billion by 2027.

- The retail and ecommerce SaaS market is expected to increase from $48.1 billion to $138.9 billion by 2027.

- By the end of 2023, up to 99% of companies will use at least one SaaS solution, driven by cost-effectiveness, scalability, and other factors.

- As the SaaS industry grows, companies must navigate challenges related to data security, service reliability, customer churn, IT integration, customer needs, and regulatory compliance.

SaaS Usage and Adoption

The rise of remote work in recent years has accelerated the adoption of cloud services that enhance online collaboration. SaaS products are integral to this trend, enabling businesses across various industries to access software applications via the internet without needing on-premises infrastructure. Here are some key statistics and trends related to SaaS usage and adoption:

- Over 80% of businesses utilize at least one SaaS application, and 88% use cloud services in some capacity.

- Up to 70% of applications used within companies are SaaS-based, with this figure expected to increase to 85% by 2025.

- Large organizations with more than 10,000 employees use around 447 SaaS apps on average, while medium to small businesses estimate that 45% of their software is cloud-based.

The CRM sector alone is projected to reach a market share of $60 billion by 2025, with accounting, CMS (content management systems), and CRM apps among the most widely used. High SaaS adoption rates are seen in technology, marketing, advertising, healthcare, education, financial services, retail, and manufacturing. Globally, there are estimated to be around 14 billion SaaS users. As remote work becomes more common, the productivity segment is expected to grow at a 10.6% CAGR from 2022 to 2028. Enterprise software constitutes a significant 70% of SaaS market revenue, driven by the shift to cloud-based operations.

- CRM alone is expected to achieve a market share of $60 billion by 2025, with accounting, CMS, and CRM apps being particularly popular.

- Industries with high SaaS adoption include technology, marketing, advertising, healthcare, education, financial services, retail, and manufacturing.

- There are estimated to be around 14 billion global SaaS users.

- As remote work continues to rise, the productivity segment is projected to grow at a 10.6% CAGR from 2022 to 2028.

- Enterprise software holds 70% of the SaaS market revenue, reflecting the increase in cloud-based office solutions.

SaaS Company Metrics

We often work with founders who have leveraged their own resources to achieve early success but encounter growth plateaus, commonly around $25,000 in MRR, though it can occur even at higher levels.

SaaS Academy has successfully guided nearly 50 companies to their ideal exit. Clients of SaaS Academy see a 209% increase in MRR within the first 6 months, along with a 9x boost in conversion rates, a 32% reduction in churn, and a 57% improvement in customer acquisition.

- SaaS Academy has helped nearly 50 companies reach their optimal exit.

- Clients of SaaS Academy experience a 209% increase in MRR within the first 6 months.

- On average, SaaS Academy clients see a 9x increase in conversion rates, a 32% decrease in churn, and a 57% rise in customer acquisition.

SaaS Pricing Statistics

SaaS companies employ various payment models tailored to organizations and individual users. These generally fall into three categories: Freemium, Usage-Based, and Variable pricing. Below is a breakdown of popular payment methods and structures:

- Research shows that 44% of companies prefer sales-negotiated pricing, 34% opt for fixed pricing, and 24% use variable pricing models.

- Usage-based pricing is growing in popularity, with 56% of companies expected to use this model in 2023.

- Freemium models remain popular, with 48% of SaaS companies offering free limited-use options or trials. About 40% offer discounts on annual subscriptions.

- 82% of SaaS companies list their prices on their website.

- 64% of businesses are considering changing their pricing method.

- Around 46% of SaaS companies utilize multiple pricing pages targeting different service types or market segments.

VC Funding of SaaS Companies

SaaS growth is closely tied to venture capital (VC) funding, which has surged in recent years due to rising end-user demand. Key figures related to VC funding include:

- In 2020, a record $48.5 billion was invested in 2,600 SaaS companies, surpassing the previous year’s record by $5 billion.

- SaaS startups attracted over $30 billion in VC investment in 2022, with up to 45% of all VC funding directed toward SaaS-based business models.

- In 2021, there were over 337 unicorn companies globally, alongside 15 decacorns (companies valued at over $10 billion).

- Only 0.6–0.9% of companies applying for VC funding are successful, making it crucial for SaaS businesses to have strong growth potential and a solid business plan to stand out in a highly competitive industry.

- Venture funding can carry significant risk for founders, particularly with liquidation preferences, potentially leaving them empty-handed during liquidity events, as seen with Rand Fishkin.

Major tech companies like Google, Amazon, and Facebook collectively raised less than $250 million before going public, highlighting the value of capital efficiency in achieving successful outcomes.

SaaS Stats from Countries Other Than the US

While the United States leads the global SaaS market, several other countries are experiencing significant growth in this sector, demonstrating the worldwide adoption of Software as a Service. Below are key statistics highlighting SaaS growth across various regions:

India

India has rapidly emerged as a major player in the SaaS industry, driven by an expanding tech ecosystem and a strong startup culture. In 2023:

- Revenue: The SaaS industry generated $2.15 billion, with projections to reach $3.25 billion by 2027.

- Startups: India is home to over 10,000 SaaS startups, positioning it as a global SaaS hub .

China

China’s SaaS market is experiencing robust growth, supported by government policies and an abundant supply of tech talent. In 2023:

- Revenue: The SaaS market is expected to reach €15.92 billion.

- Growth Factors: The country’s rapid tech development and cloud infrastructure expansion contribute to this upward trend .

Europe

The European SaaS market, particularly in the UK and Germany, is also booming. As of 2023:

- Revenue: Europe’s SaaS market is predicted to hit $61.04 billion.

- Key Players: In addition to the UK and Germany, countries like France, Spain, and Italy are contributing significantly to the region’s SaaS landscape .

Australia

Australia is becoming a key player in the global SaaS industry, home to major success stories like Atlassian and Canva. In 2023:

- Revenue: SaaS revenue in Australia is projected to reach $4.43 billion.

- Tech Hubs: Major cities like Sydney and Melbourne are at the heart of Australia’s growing SaaS ecosystem .

The Benefits of SaaS

SaaS (Software as a Service) adoption is growing across industries, thanks to its agility, scalability, and a range of other benefits that make it an attractive choice for businesses. Some key benefits in numbers:

- Agility and Scalability: 70% of Chief Information Officers (CIOs) prefer SaaS due to its agility and scalability, allowing businesses to adapt and scale as needed.

- Employee Engagement: 86% of businesses report enhanced employee engagement and experience with the use of SaaS solutions.

- Faster Deployment: Companies using SaaS solutions can deploy new services or products up to 40% faster than those relying on traditional software.

Challenges of SaaS

Despite the benefits, SaaS organizations and users face several challenges that need to be addressed for effective use:

- Customer Churn: The average churn rate in SaaS companies is about 5%, which is higher than the average of 3% in other industries. Retaining customers is a significant challenge for SaaS providers.

- Specialization and Value Perception: The more specialized and focused a SaaS product is, the higher the perceived value. SaaS companies need to resist the urge to expand too broadly and instead refine their offerings for greater impact.

- Security Issues: Security incidents remain a major concern, particularly due to misconfigurations, with 43% of SaaS companies having faced security issues for this reason. Monitoring security is another area of concern, with only 18% of IT departments properly overseeing potential data leaks.

- Unauthorized Access: For SaaS adopters, unauthorized third-party access poses a real threat, with 56% of companies citing this as a significant security challenge.

- Offboarding Challenges: Offboarding employees from SaaS applications can be time-consuming, with companies reporting it can take up to 7 hours per user to complete.

Conclusion

SaaS is a powerful and transformative model, offering businesses scalability, flexibility, and cost savings. However, its adoption also brings challenges, such as customer churn and security concerns. To fully benefit from SaaS, businesses need to adopt a strategic approach, stay informed about emerging trends, and maintain close collaboration with SaaS providers. By addressing these challenges effectively, organizations can maximize SaaS’s potential to drive growth, efficiency, and productivity.

Ready to Build Your Own SaaS Success Story?

At Unoiatech, we specialize in helping businesses bring their SaaS vision to life. Whether you’re looking to scale, optimize, or launch from scratch, our team has the expertise to make it happen. Want to see how we helped one of our clients build a $900M SaaS product? Check out our case study here and discover how we can do the same for you.