MRR (Monthly Recurring Revenue) is arguably the most crucial metric for SaaS companies. ARR (Annual Recurring Revenue or Annualized Run Rate) is another key metric, but the two have important distinctions. While both track recurring revenue, they offer different perspectives on your company’s financial health. Let’s explore the key differences between MRR and ARR, and examine when each is most appropriate for your business.

What is the Difference Between ARR and MRR?

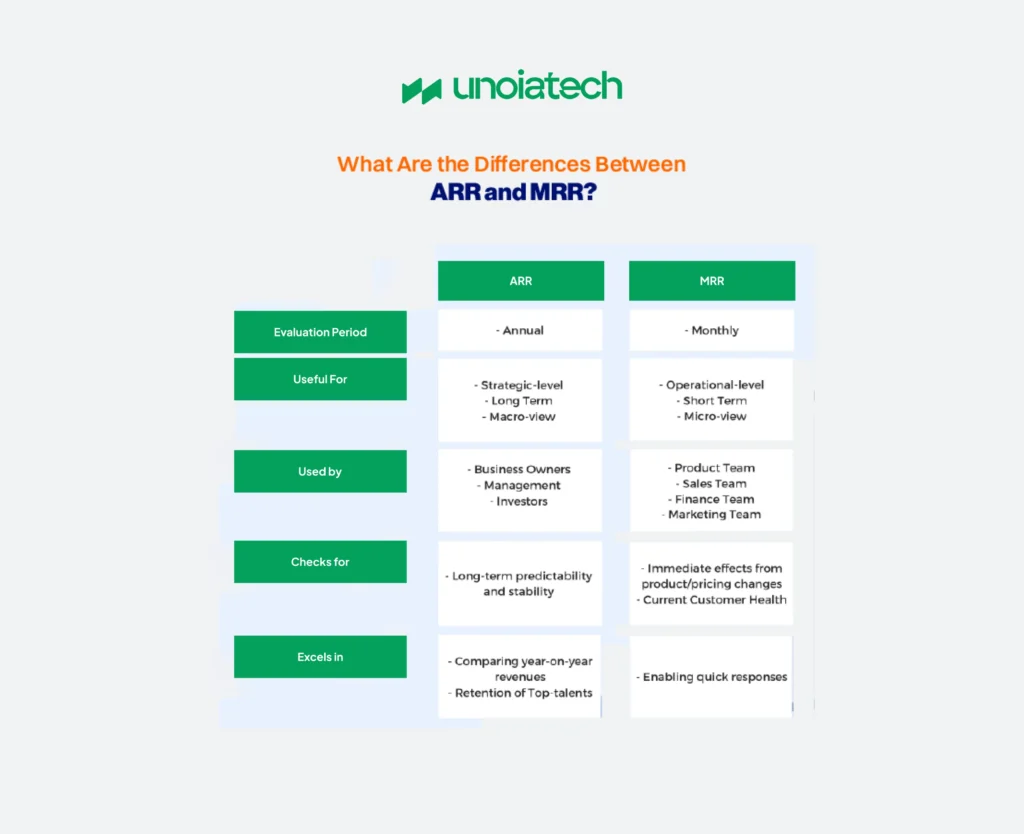

While ARR and MRR both measure recurring revenue, their primary difference lies in the time frame they cover and the type of insights they provide:

- ARR offers a broader, long-term view, giving an annualized snapshot of revenue. This metric is useful for understanding the overall trajectory of your business and is especially relevant for companies with long-term contracts.

- MRR focuses on monthly revenue patterns, allowing for a more granular, short-term analysis of your company’s operations. It helps you gauge how your business is performing on a month-to-month basis, making it ideal for monitoring immediate changes or trends.

- ARR is typically used by companies with annual or multi-year contracts, making it more suited to enterprise-level businesses. MRR is more beneficial for startups and companies with monthly subscription models, where short-term changes can be crucial for making quick operational adjustments.

What is MRR?

MRR, or Monthly Recurring Revenue, reflects the consistent income a business earns each month from its subscribers. Unlike product-based companies that rely on one-time purchases, SaaS companies use MRR to maintain a steady cash flow.

MRR tracks the financial health of a subscription business, continuously changing as new customers sign up or existing customers churn. It’s a dynamic metric that provides real-time insights into how well the company is retaining its subscribers and attracting new ones.

For SaaS businesses, the value proposition must be strong enough to convince customers to renew month after month. The more stable and predictable your MRR, the healthier your business is in the short term.

Who is it for?

MRR is most suitable for businesses with monthly subscription models, typically early-stage or mid-sized SaaS companies. These companies need to track immediate revenue fluctuations to make quick adjustments. It’s also useful for startups looking to scale, as the month-over-month revenue data helps identify growth opportunities and operational inefficiencies. Companies in the early stages benefit from the agility that MRR provides, as it allows them to adapt quickly to customer behavior and market changes.

Importance of MRR for Your SaaS Business

- Monthly Trends: MRR gives a clear monthly snapshot of how your company is performing. Since SaaS businesses operate in rapidly changing environments, this monthly trend helps identify growth opportunities and challenges in real-time.

- Financial Planning: MRR is an important indicator for financial forecasting and cash flow management. It helps companies predict the revenue they will earn in the coming months, making it easier to plan for expenses and investments.

- Growth and Momentum: Consistently increasing MRR shows that your company is growing and gaining momentum. If your MRR is stagnant or decreasing, it can be a signal to address customer retention or acquisition strategies.

- Focus on High-Value Clients: By calculating Customer Lifetime Value (CLTV) through MRR, you can identify your most valuable clients. Prioritizing these customers and improving their experience can help reduce churn, increase retention, and boost profitability over time.

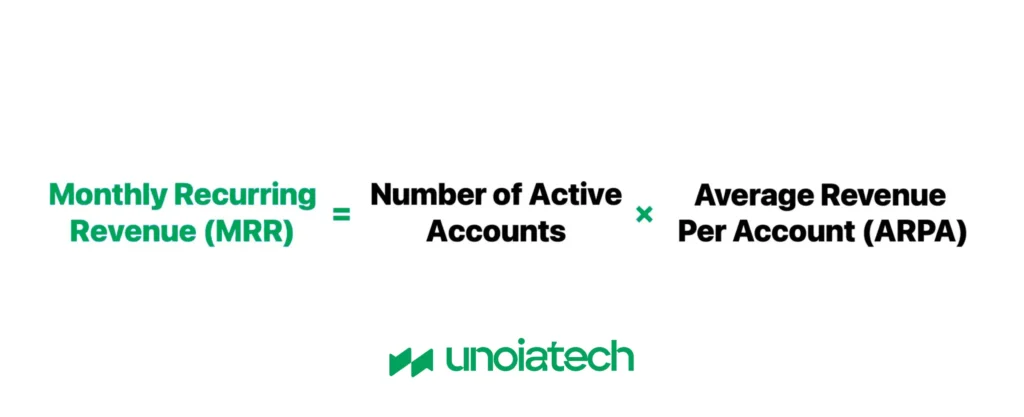

MRR Calculation Formula

The formula for calculating MRR is simple but effective:

MRR = ARPU (Average Revenue Per Unit) × Number of Subscribers

Let’s break it down:

- If you have 25 subscribers paying $100 per month, the MRR = 100 × 25 = $2500.

- If subscribers pay varying amounts, the formula still applies. For instance, with 10 subscribers paying $150/month and 15 subscribers paying $100/month, the MRR = (10 × 150) + (15 × 100) = $3000.

Keep in mind that subscriber payment amounts can vary due to discounts, add-ons, or different service tiers.

What is ARR?

ARR stands for Annual Recurring Revenue, and it represents the total recurring revenue a SaaS company generates over a year from its subscription customers. Like MRR, ARR tracks predictable income, but it covers a longer time frame. ARR is useful for assessing your company’s financial performance over a full year, offering a comprehensive view of your growth and revenue trends.

ARR is influenced by multiple factors, including new customer sign-ups, subscription renewals, upgrades, and customer churn. Companies often use ARR to understand their long-term revenue projections, making it easier to set yearly goals and budgets.

Who is it for?

ARR is predominantly used by B2B SaaS companies that sell annual or multi-year subscription plans. Companies with longer contract durations benefit from tracking ARR because it allows them to monitor the long-term value of customer relationships. Unlike MRR, which focuses on short-term fluctuations, ARR gives a holistic view of a business’s financial health over an extended period.

Importance of ARR for Your SaaS Business

- Assessing Financial Health: ARR helps you evaluate your business’s long-term financial performance. By tracking ARR growth, you can determine whether your total annual revenue is increasing or decreasing and understand the reasons behind those trends.

- Budgeting: ARR allows for better financial planning, especially when allocating resources to areas like employee compensation, marketing, or infrastructure upgrades. It provides the stability needed to make long-term investments in your business.

- Forecasting Revenue: ARR makes revenue forecasting more accurate, giving you a clearer picture of future cash flow. This helps you plan for large expenses with greater confidence.

- Attracting Investors: A strong ARR can make your company more attractive to investors or potential buyers, as it shows consistent revenue streams and long-term contractual obligations, which signal stability and future growth potential.

ARR Calculation Formula

ARR is calculated similarly to MRR but on an annual basis:

ARR = 12 × MRR

For example, if your MRR is $5000, then your ARR = 12 × 5000 = $60,000.

Alternatively, if you have 10 subscribers who each pay $1000 annually, then ARR = 10 × 1000 = $10,000.

For companies with multi-year contracts, it’s important to annualize the value of each contract. If 5 subscribers sign 3-year contracts worth $6000, 10 subscribers sign 2-year contracts worth $5000, and 40 customers have 1-year contracts worth $3000, the ARR would be:

ARR = 5 × (6000 / 3) + 10 × (5000 / 2) + 40 × (3000) = $155,000

ARR vs. MRR: Which One Should You Use?

The primary difference between ARR and MRR is the time frame they measure. ARR provides a long-term, annual perspective, while MRR offers a short-term, monthly view.

- Use ARR if your company operates with annual or multi-year contracts, giving you a clearer picture of long-term growth and stability.

- Use MRR for companies that rely on monthly subscriptions or are in the early stages, where monitoring short-term changes can be crucial for operational adjustments.

MRR is essential for short-term planning and monitoring the immediate impact of changes, while ARR provides insight into long-term goals and growth trajectories. When selling your business, ARR is typically the key metric buyers consider, as it offers a more stable view of revenue potential.

Is ARR 12 Times MRR?

Not always. While ARR is typically calculated as 12 times MRR, this assumes that the customer base remains constant. In reality, MRR can fluctuate due to new sign-ups, churn, and contract upgrades or downgrades, meaning the true ARR may deviate from the simple 12x MRR formula. Changes in MRR throughout the year can cause ARR to vary, so it’s important to monitor both metrics regularly.

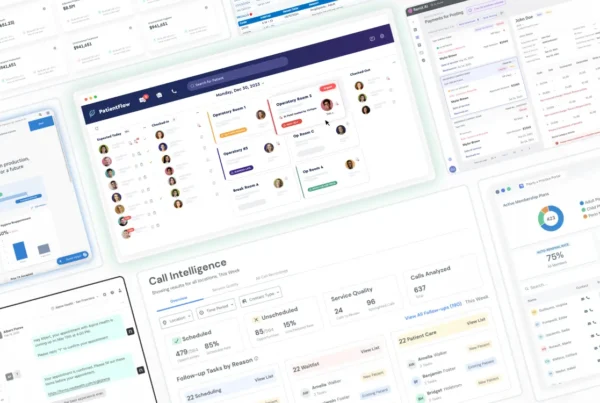

Ready to Build Your Own SaaS Success Story?

At Unoiatech, we specialize in helping businesses bring their SaaS vision to life. Whether you’re looking to scale, optimize, or launch from scratch, our team has the expertise to make it happen. Want to see how we helped one of our clients build a $900M SaaS product? Check out our case study here and discover how we can do the same for you.