What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is a key metric for subscription-based businesses that tracks the yearly revenue generated from ongoing subscriptions. ARR provides insight into the predictable, recurring income a company expects from customers who have committed to renew their subscriptions for another year at the same rate.

ARR is often more reliable than Monthly Recurring Revenue (MRR) as it offers a clearer view of long-term growth. Businesses use ARR to make more informed financial projections. To efficiently track ARR and other key metrics, utilizing a comprehensive SaaS Metrics Template is essential.

What is included in ARR?

ARR includes all types of recurring revenue, such as subscription fees, membership dues, and software licenses. Specifically, it covers:

- Recurring payments for services billed monthly

- Payments for products delivered quarterly or annually

- Revenue from subscriptions to digital content

- Membership fees for online communities

For instance, if a customer subscribes for $120 per year, their contribution to ARR is $120. Similarly, if a customer pays $120 monthly, their ARR contribution is $1,440 ($120 x 12).

What Not to Include in ARR

Not all revenue is considered part of ARR. One-time fees such as installation costs or sign-up charges, as well as revenue from non-recurring services like consulting, are excluded. Similarly, discounts and price adjustments should not be included when calculating ARR. A review of subscription contracts will help identify which charges are truly recurring.

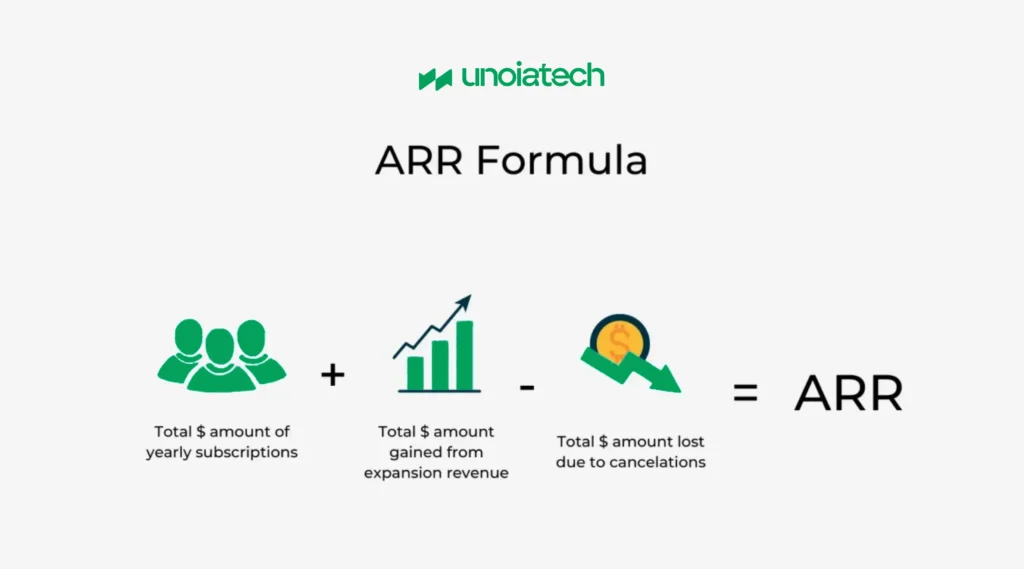

How to Calculate ARR

There are two primary methods to calculate ARR:

There are two primary methods to calculate ARR:

- Simple Addition Method:This straightforward approach involves adding up all the recurring revenue expected within a year. However, this can be challenging if customer subscription terms vary.

- ARR Formula:A more precise method uses the formula:ARR = (Total revenue from new subscriptions in a period) + (Recurring revenue from existing subscriptions) – (Churned revenue) + (Upgrades or downgrades)

This formula can be applied monthly, quarterly, or annually, depending on the desired calculation period.

ARR Calculation Examples

- Monthly Basis:A company expecting $1,000 in recurring revenue per month will have an ARR of $12,000 ($1,000 x 12).

- Quarterly Basis:If a company anticipates $3,000 per quarter, the ARR becomes $12,000 ($3,000 x 4).

- Annual Basis:For $10,000 in annual recurring revenue per client, the ARR equals $10,000 ($10,000 x 1).

How to Increase ARR

Increasing ARR is a vital business goal, and there are several strategies to achieve this:

- Acquire New Customers:Growing your customer base directly boosts ARR. Marketing teams play a critical role in acquiring leads and converting them into long-term subscribers.

- Upsell Annual Subscriptions:Offering discounts for yearly subscriptions versus monthly ones can lock in customers and reduce churn. While it may seem like a revenue loss, this strategy often results in long-term gains, as customers are more likely to remain subscribed for an entire year.

This tactic is frequently used by gyms, where yearly discounts ensure consistent revenue, despite some members not fully utilizing their memberships.

What is the Difference Between ARR and MRR?

While ARR measures the total expected revenue over a year, Monthly Recurring Revenue (MRR) tracks the income received in a month. ARR offers a more stable and reliable metric for predicting long-term growth, while MRR provides a snapshot of monthly performance. Both are crucial, but ARR is a better indicator of long-term sustainability.

Why is ARR an Important Metric for Subscription Businesses?

ARR provides a dependable projection of a company’s future revenue, making it a vital metric for long-term financial planning. While MRR can fluctuate, ARR delivers a steady forecast, helping SaaS businesses plan resources and adapt pricing strategies to maximize profitability.

Streamline Your Financial Planning

To optimize financial planning, consider downloading our SaaS Company Operating & Valuation Model Template. Here’s how to access it:

- Visit our template webpage and click “Download Now For Free!”

- Complete a short form with basic information about your business.

- Open the template in Google Sheets or Microsoft Excel.

- Input your company’s financial data, and the template will automatically calculate key metrics.

FAQs

Is ARR the same as revenue?

No, ARR only includes recurring revenue, whereas total revenue includes all income sources, both recurring and one-time.

What is Committed Annual Recurring Revenue (CARR)?

CARR refers to the guaranteed revenue a company expects from subscriptions over a year. It’s calculated by adding recurring revenue from both new and existing subscriptions, minus any churned revenue. CARR helps companies predict future revenue more accurately, aiding in business planning.

CARR Calculation Examples

- Monthly Basis:If a company expects $1,000 in recurring revenue from new subscriptions and $2,000 from existing subscriptions, their CARR would be $3,000.

- Quarterly Basis:With $3,000 in new and $6,000 in existing subscription revenue, the CARR totals $9,000.

- Annual Basis:If a company projects $12,000 from new and $24,000 from existing subscriptions annually, the CARR would be $36,000.