In today’s competitive SaaS landscape, simply acquiring customers isn’t enough. You need to know how much each customer contributes to your bottom line over time. That’s where Customer Lifetime Value (LTV) comes into play. Leading SaaS experts, such as Dan Martell, recommend tracking this metric to guide marketing strategies and help your business scale effectively. Knowing your LTV allows you to assess how much you should invest in customer acquisition and retention for sustainable growth.

In this article, we’ll break down what LTV is, how to calculate it, and why it’s a crucial metric for growing your SaaS business.

What Is Customer Lifetime Value?

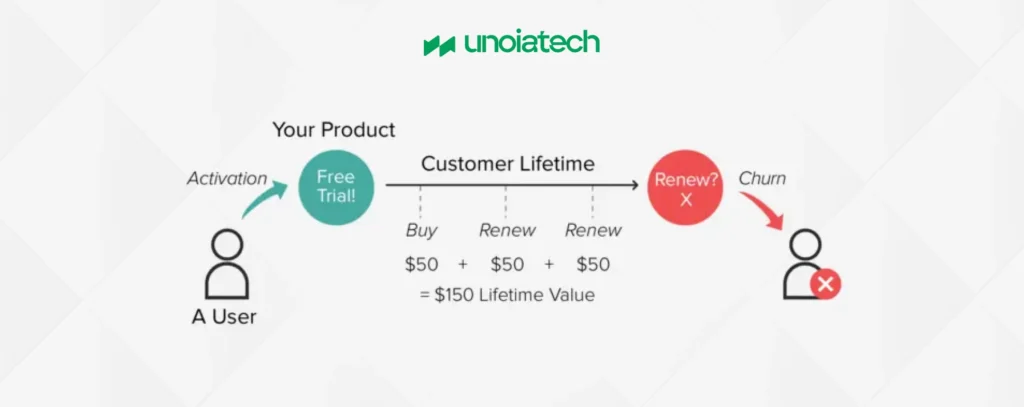

Customer Lifetime Value (LTV) measures the total revenue your business expects to generate from a single customer over the course of their relationship with your company. It’s especially important in SaaS because customers typically pay on a recurring basis. This metric helps you determine the worth of your average customer and predict future revenue streams, guiding essential business decisions like pricing, product development, and marketing investment.

For SaaS businesses, LTV is a critical measure to ensure that you’re not just acquiring customers but also keeping them long enough to generate a positive return on your acquisition efforts.

What Is the Difference Between LTV and CLV?

What Is the Difference Between LTV and CLV?

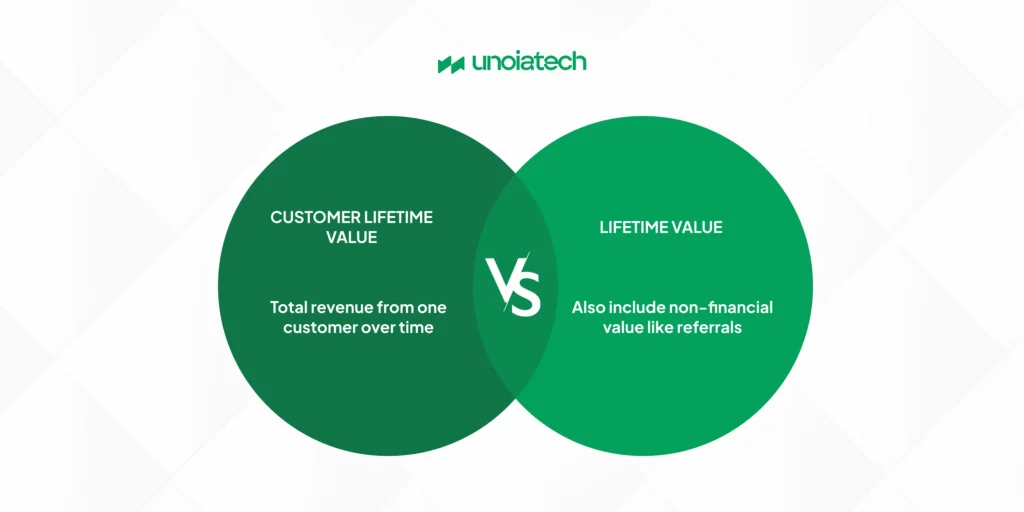

LTV and CLV (Customer Lifetime Value) are often used interchangeably, but there is a subtle distinction. LTV is an overall metric that calculates the cumulative value generated by all your customers, giving you a macro view of your business’s performance. CLV or CLTV, on the other hand, refers to the value brought by an individual customer over their lifetime with your company.

Knowing both LTV and CLV allows you to assess trends at a macro and micro level. While LTV helps with company-wide strategies like setting budgets, CLV enables more personalized strategies, such as customer segmentation, targeted marketing, and loyalty programs. Both metrics are vital to developing well-rounded business insights and ensuring you’re making smart investments in acquiring and retaining customers.

How to Calculate LTV

Calculating LTV can be done through several different methods, depending on how much detail you want and the data you have available. Below are three effective approaches:

- Basic LTV Calculation: This method involves multiplying three key values: the average purchase value, purchase frequency, and customer lifespan.

- Average Purchase Value is determined by dividing your total revenue over a period by the number of purchases made in that time.

- Purchase Frequency is calculated by dividing the total number of purchases by the number of customers.

- Customer Lifespan is the average duration a customer stays with your business. Multiply these three metrics, and you’ll get a rough estimate of your LTV.

- ARPA/ARPU-Based LTV Calculation: For a more refined calculation, use Average Revenue Per Account (ARPA) or Average Revenue Per User (ARPU). Divide your Monthly Recurring Revenue (MRR) by the number of accounts (ARPA) or users (ARPU), and then multiply by the customer lifespan to determine LTV. Alternatively, you can divide ARPA or ARPU by your churn rate to assess how long customers are staying and how much they’re contributing.

- Advanced LTV Formula: To calculate LTV with even more accuracy, you’ll need to incorporate gross margin and revenue churn rate. First, determine your gross margin percentage by subtracting the cost of goods sold from your total revenue, then divide that number by your revenue and multiply by 100. Divide this result by your revenue churn rate (the percentage of revenue lost over a specific time period). Multiply this figure by ARPA to find a highly accurate LTV.

These methods offer varying levels of detail, allowing you to choose the most appropriate formula for your SaaS business depending on the available data and your needs.

Why Is LTV Important for SaaS?

LTV is a critical metric for SaaS companies because it provides long-term visibility into customer profitability. Without LTV, it’s difficult to make informed decisions about customer acquisition and retention strategies. For example, knowing your LTV can help you determine how much to spend on acquiring new customers and how much you should invest in customer retention programs.

More importantly, LTV informs your Customer Acquisition Cost (CAC), which tells you how much it costs to acquire a new customer. The relationship between LTV and CAC is crucial in determining whether your marketing and sales efforts are financially viable. If your LTV to CAC ratio is at least 3:1, you’re likely in a strong position to scale. If it’s lower than that, it means you’re spending too much on customer acquisition or not getting enough value from your customers over time.

Understanding LTV enables you to optimize your budget, improve ROI, and ensure long-term profitability.

How to Increase Customer Lifetime Value

Maximizing your LTV is a key way to boost profitability without constantly seeking new customers. Below are three effective strategies to increase customer lifetime value in your SaaS business:

- Increase Average Order Value (AOV): Encouraging customers to spend more per transaction is an effective way to increase their lifetime value. You can achieve this by offering upgrades, premium features, or bundled services that make each purchase more valuable. Upselling and cross-selling are essential tactics here, helping customers see more value from your product offerings.

- Encourage More Frequent Purchases: While increasing the average order value is important, so is encouraging customers to make purchases more often. Send regular reminders, promote new features, and engage customers through email marketing and social media campaigns. Keeping customers engaged with your brand helps maintain their loyalty and encourages them to make more frequent purchases.

- Focus on Retention: Customer retention is one of the most effective ways to maximize LTV. Happy customers who stay longer with your brand generate more value. Improving your customer onboarding, providing excellent customer support, and consistently delivering new updates can keep your customers engaged. Implementing a customer feedback loop and solving their pain points in real-time will ensure they stick around for the long haul.

How Does Customer Lifetime Value Impact Marketing?

LTV directly influences your marketing strategy by determining how much you should invest in customer acquisition and retention. A high LTV suggests that your business is benefiting from long-term relationships with customers, which can justify higher acquisition costs. Conversely, a low LTV indicates that you should prioritize customer retention and invest in improving customer experience before increasing your marketing spend.

Segmenting your customers by LTV also enables you to tailor your marketing efforts. For example, high-value customers may respond better to personalized offers or premium services, while lower-value customers may need more attention in onboarding and support.

Aligning your marketing strategy with LTV helps you target the right audience, improve retention, and allocate resources more effectively.

Maximize LTV and CAC for SaaS Success

To drive success in the SaaS industry, it’s essential to monitor both LTV and CAC carefully. A strong LTV-to-CAC ratio ensures that your business is acquiring valuable customers at an efficient cost, paving the way for sustainable growth. By keeping these metrics in balance, you can optimize your sales funnel, improve customer retention, and scale your business effectively.

In conclusion, understanding and optimizing LTV helps ensure that your marketing investments are delivering maximum value.

Ready to Build Your Own SaaS Success Story?

At Unoiatech, we specialize in helping businesses bring their SaaS vision to life. Whether you’re looking to scale, optimize, or launch from scratch, our team has the expertise to make it happen. Want to see how we helped one of our clients build a $900M SaaS product? Check out our case study here and discover how we can do the same for you.

What Is the Difference Between LTV and CLV?

What Is the Difference Between LTV and CLV?