Starting a SaaS business is an exciting venture, but understanding how to secure SaaS financing at each stage is key to growth. After conducting your research, planning your upfront costs, and developing a business model, you’re ready to explore SaaS financing options.

The SaaS industry is booming, expected to reach a value of $232 billion by 2024, making it crucial for entrepreneurs to find effective SaaS financing methods. Here’s a guide to help you navigate funding options, from short-term loans to angel investors, ensuring your SaaS startup gets the financial boost it needs.

Challenges in SaaS Financing

Challenges in SaaS Financing

Securing SaaS financing isn’t without its challenges. Many founders struggle because they approach investors or lenders unprepared. To succeed, you need to present a clear vision of your product and how it will solve a significant market problem.

Another challenge is maintaining control. As you seek SaaS financing, you may feel like you’re losing ownership of your company. Choosing the right investors who share your vision is crucial to navigating this phase smoothly.

Opportunities in SaaS Funding

While securing SaaS financing can be tough, it comes with opportunities. Partnering with experienced investors, venture capitalists, or specialized lenders can not only provide capital but also open doors to new customers and offer invaluable growth advice.

Groups like SaaS Capital or Capchase specialize in providing SaaS financing to startups. Reaching out to such firms can offer tailored support, helping you make the right financing choices for your business.

Startup Stage Financing

In the startup or seed stage, SaaS financing focuses on market research, developing a prototype, and building a strong team. Early-stage funding is essential for giving SaaS startups the momentum they need to get off the ground.

Series A Funding

Series A is your first major round of fundraising. At this stage, you will engage with venture capital firms, angel investors, and other financing sources to further develop your product and team. The goal here is to refine your business model and ensure your product fits the market. Investors will be looking for companies that show strong potential for growth. It’s crucial to have clear metrics, such as customer acquisition and retention rates, to attract this level of funding.

Venture Capital

Venture capital firms play a key role in SaaS growth, offering tailored loans or equity investment to companies they back. These firms will assess your company’s value through a process of due diligence, which includes analyzing your financials, team, market opportunity, and competitive advantage. It’s important to negotiate for favorable terms, especially around equity dilution and control. VC firms can offer not only funding but also strategic guidance and access to networks that can accelerate your company’s growth.

Angel Investors

Angel investors are experienced individuals who offer equity or convertible debt financing. They typically invest in early-stage startups, often before larger venture capital firms get involved. Beyond just providing capital, angel investors often bring valuable industry knowledge and contacts, making them ideal partners for scaling. Their investment amounts may be smaller than those of VC firms, but they tend to be more flexible in terms of control and returns.

Bootstrapping

Bootstrapping involves using personal funds or company revenue to grow the business. Though challenging, it offers the advantage of retaining full control and avoiding external investors. Bootstrapping can be a slower route to growth but allows you to maintain equity and stay independent. Many successful entrepreneurs have grown their SaaS companies this way, focusing on generating revenue from the start and reinvesting profits to fuel expansion.

Growth Stage Financing

As your company grows, your funding will primarily focus on scaling. At this stage, you may need larger amounts of capital to expand your operations, increase marketing efforts, and build infrastructure. Growth stage financing can come from additional venture capital rounds or alternative funding options like revenue-based financing. The key here is to balance growth with profitability while managing cash flow effectively to ensure sustainable scaling.

Series B Funding

By Series B, your company is established and ready for the next level of expansion. This round involves seeking additional capital to drive growth, whether it’s for hiring, product development, or market expansion. Investors in Series B rounds are looking for businesses that have demonstrated product-market fit and are ready to scale rapidly. The focus shifts from proving your concept to optimizing your business processes and expanding your market presence.

Non-Dilutive Financing

Investors at this stage often seek protection from dilution. Non-dilutive financing allows them to maintain returns even as your company scales. This type of financing can come in various forms, such as grants, loans, or revenue-based financing, where you do not give up equity in exchange for capital. Non-dilutive options are attractive because they allow you to grow your business without surrendering ownership or control, making them a preferred choice for companies that are wary of further dilution.

Revenue-Based Financing

Some investors prefer a model where they receive a percentage of your revenue until their investment is repaid. This type of financing is beneficial for SaaS businesses because repayments are tied to your revenue performance, offering flexibility during periods of slower growth. It can be a great option for companies that want to avoid taking on equity partners or dealing with strict loan repayment terms. The flexibility of this model helps align investor interests with the long-term success of the business.

Maturity Stage Financing

During the maturity stage, your growth may slow, and investors might begin considering their exit strategies. This is when your focus shifts from scaling to sustaining your market position and maximizing profitability. Investors may start exploring ways to liquidate their shares, either through acquisition or IPO. At this stage, you can explore traditional financing options like term loans or private equity, both of which allow you to continue funding your business while planning for an eventual exit.

Term Loans

Mature businesses with proven track records can access term loans from banks. These loans provide a lump sum of capital upfront, which you pay back over time with interest. By demonstrating strong financials, including consistent revenue and profitability, you can secure favorable loan terms such as lower interest rates and flexible repayment schedules. Term loans are a great option for businesses that need a predictable source of funding for expansion, acquisitions, or other large expenses.

Private Equity

Private equity firms can also be a source of SaaS financing at this stage, typically in exchange for a large or majority stake in your company. They will help drive growth before eventually planning an exit.

Key Metrics and KPIs for SaaS Financing

When seeking SaaS financing, investors look at key metrics such as Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and Customer Churn. Monitoring these metrics helps demonstrate your company’s financial health and growth potential.

- Monthly Recurring Revenue (MRR): Investors analyze MRR to gauge how well your business is retaining customers and generating predictable income.

- Annual Recurring Revenue (ARR): ARR projects your business’s annual earnings and is a critical figure for long-term SaaS financing planning.

- Customer Acquisition Cost (CAC): Keeping CAC low ensures you can acquire customers cost-effectively, which is attractive to potential investors.

Conclusion

When launching or scaling a SaaS business, understanding your SaaS financing options is vital. From bootstrapping to venture capital, there are many avenues to explore. By presenting your business metrics clearly and aligning with the right investors, you can secure the funding you need to grow your SaaS company successfully.

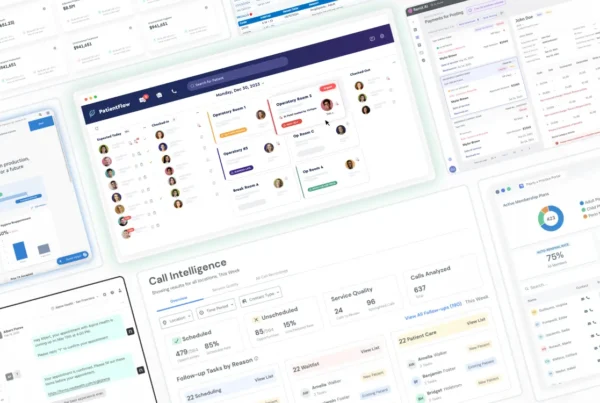

Ready to Build Your Own SaaS Success Story?

At Unoiatech, we specialize in helping businesses bring their SaaS vision to life. Whether you’re looking to scale, optimize, or launch from scratch, our team has the expertise to make it happen. Want to see how we helped one of our clients build a $900M SaaS product? Check out our case study here and discover how we can do the same for you.

Challenges in SaaS Financing

Challenges in SaaS Financing