Metrics are essential to the success of any business, especially in the subscription model. One of the most critical financial metrics used to evaluate a subscription-based business is MRR.

What is MRR?

MRR stands for Monthly Recurring Revenue. It’s a standardized metric that reflects how much revenue a business can expect to generate in a month from its paying customers. Unlike businesses reliant on one-time product sales, subscription-based companies rely on a steady revenue stream from customers who continuously see value in their service, ensuring they pay month after month. A SaaS business relying on the subscription model does not rely on one-time sales like a product-based company does.

In subscription-based businesses, customer sign-ups and cancellations (churn) are a constant cycle, causing MRR to fluctuate. Monitoring MRR trends month over month provides insight into the overall health of a company.

Utilizing a well-designed SaaS Metrics Template can assist you in tracking MRR and other critical metrics to plan for future growth.

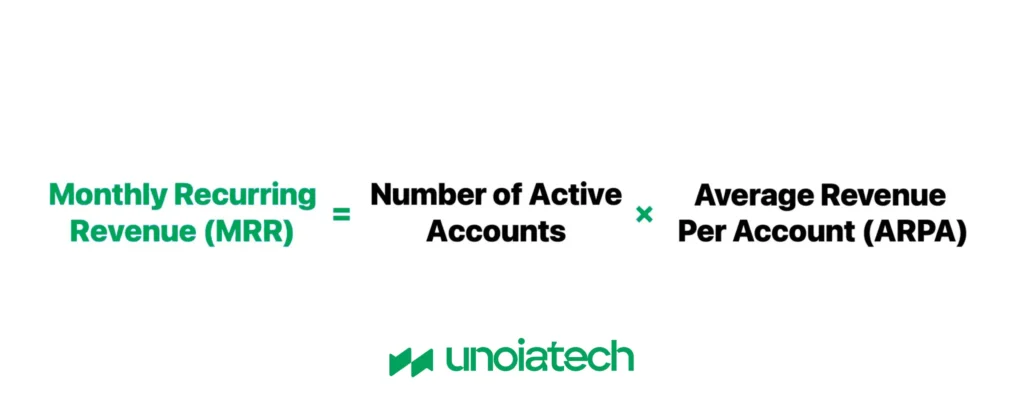

How to Calculate MRR – MRR Formula

Calculating MRR is straightforward. It’s determined by multiplying the total number of subscribers by the Average Revenue Per User (ARPU).

For example, if you have 50 subscribers paying $100 per month:

- Number of subscribers = 50

- ARPU = $100

- MRR = 50 X 100 = $5000

If some customers are on annual contracts, their annual fees must be divided by 12 to get the monthly revenue. For instance, if 80 customers pay $900 annually:

- Number of subscribers = 80

- ARPU = $900 / 12 = $75

- MRR = 80 X 75 = $6000

Combining different plans, such as 30 subscribers paying $100 monthly and 40 subscribers paying $600 yearly, results in:

- Total MRR = (30 X 100) + (40 X (600/12)) = 3000 + 2000 = $5000.

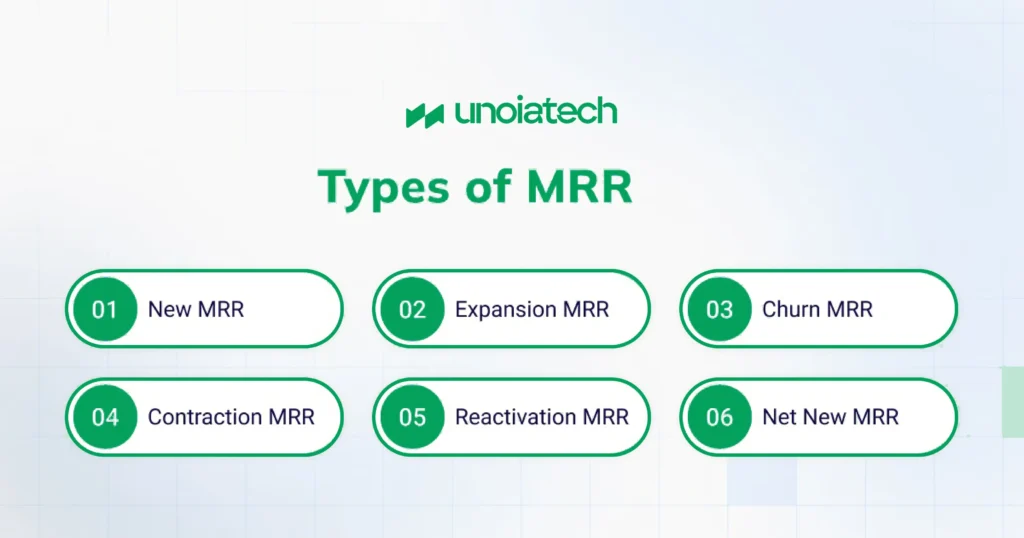

Types of MRR

Breaking down MRR provides actionable insights into business trends. Key categories include:

- New MRR: Revenue from new customers. For instance, if you sign 5 new customers at $60/month, the New MRR = 5 X 60 = $300.

- Upgrade MRR: Additional revenue from existing customers upgrading their plans. If 5 customers upgrade from $60 to $100/month, Upgrade MRR = 5 X (100 – 60) = $200.

- Reactivation MRR: Revenue from customers who canceled but returned, often with a lower acquisition cost than new customers.

- Expansion MRR: Additional revenue from existing customers, which could include upgrades, reactivations, or moving from free trials to paid plans.

All of these components increase MRR.

- Churn MRR: Revenue lost from cancellations. For example, if 5 customers paying $60/month and 8 paying $90/month cancel, Churned MRR = (5 X 60) + (8 X 90) = $1020.

- Downgrade MRR: Revenue lost when customers switch to lower-cost plans. Tracking Downgrade MRR can help spot trends, such as a rise after price increases.

- Contraction MRR: The total revenue lost from downgrades and cancellations.

Churn, Downgrade, and Contraction MRR lead to revenue loss, while New, Upgrade, and Expansion MRR lead to growth.

- Net New MRR: The net revenue change compared to the previous month. It’s calculated as: Net Expansion = Expansion MRR – Contraction MRR Net New MRR = New MRR + Net Expansion

Why is Tracking MRR Important?

Tracking MRR is crucial for subscription-based businesses. It provides a clear month-to-month view of the company’s financial performance. A consistent and growing MRR allows for more accurate financial forecasting and cash flow planning.

MRR trends can indicate business growth momentum, and a rising MRR signifies that the company is on a positive trajectory. MRR also helps calculate Customer Lifetime Value (CLTV), focusing on high-value customers for retention and upselling, which is often more cost-effective than acquiring new customers.

Monitoring MRR allows companies to budget confidently, spot potential issues, and address them before they become more significant problems.

How to Analyze MRR

Investors pay close attention to MRR because it reveals a company’s financial stability and cash flow potential. Analyzing MRR components provides insights into how to increase revenue.

For example, free-tier customers using up all available resources might be ready to upgrade to paid plans. Paying customers who rarely use the service could churn, so offering discounts or downgrades may help retain them.

Retention is crucial in SaaS businesses, where acquiring new customers can be costly. Monitoring churn and taking corrective measures when churn rates rise is vital to business success. A high Expansion MRR shows that customers are satisfied and willing to spend more on the service.

In summary, analyzing MRR provides concrete data on whether your business is growing or shrinking and offers insight into the reasons behind these changes.

How to Optimize MRR

Increasing your Monthly Recurring Revenue (MRR) involves several strategies:

- Charge More for Your ServiceAdjusting your pricing can significantly impact MRR. Many services are undervalued, so reassessing and possibly increasing your prices can reflect the true value you provide. However, be cautious not to raise prices excessively, as it may drive away existing customers.

- Upsell and Upgrade Existing CustomersFocus on existing subscribers who are most engaged with your service. Identify opportunities to upsell or encourage them to upgrade to higher-tier plans. This targeted approach can boost MRR without needing to attract new customers.

- Reduce Churn RateLowering churn, or retaining existing customers, is crucial for MRR growth. Continuously reinforce the value of your service to minimize cancellations. Providing exceptional customer support and regularly updating your service can help in this effort.

- Increase the Number of Paying SubscribersBeyond pricing and retention, expanding your customer base is essential. Here are some effective strategies:

- Leverage Word-of-Mouth: Encourage satisfied customers to share their positive experiences. Display client testimonials on your website to build credibility and attract new subscribers.

- Expand Your Email List: Offer valuable resources like white papers or e-books in exchange for email addresses. Use automated email marketing funnels to nurture leads and convert them into paying customers.

- Utilize Targeted Ads: Run advertising campaigns tailored to specific business sizes, revenue levels, or industries to attract relevant prospects.

Common Mistakes in MRR Calculation

Proper MRR calculation is crucial. Avoid these common errors:

- Neglecting Non-Monthly Billing IntervalsSubscribers may choose billing intervals other than monthly, such as quarterly or annually. Normalize these to a monthly amount to accurately reflect MRR.

- Including Non-Recurring RevenueOnly recurring revenue should be included in MRR. One-time payments, while beneficial for cash flow, do not contribute to MRR.

- Misinterpreting MRR as an Accounting FigureMRR is a performance metric, not an official accounting figure. It’s a useful indicator of business health but not recognized by accounting standards like GAAP or IFRS.

- Counting Unconverted Trial UsersDon’t include revenue from trial users in your MRR calculations. Only include revenue from users who have converted to paying subscribers.

- Overlooking MRR ComponentsUnderstand and track all types of MRR, not just the overall figure. Components such as New MRR, Upgrade MRR, and Churn MRR each provide valuable insights.

- Ignoring DiscountsIf you offer discounts (e.g., 50% off for the first six months), only include the discounted amount in the MRR. The full price should not be counted.

Annual Recurring Revenue (ARR)

ARR is a related metric that reflects expected annual revenue. It smooths out fluctuations seen in MRR and provides a more stable view of long-term performance.

MRR – The Essential SaaS Indicator

MRR offers a real-time snapshot of your business’s financial health and growth trajectory. When accurately calculated, it serves as a crucial predictor for forecasting future performance and making informed business decisions.