With the wealth of financial reporting solutions available today, there are compelling reasons to stop creating reports manually. Despite its longstanding use, manual reporting is no longer sufficient in the fast-paced, modern business landscape. It creates challenges for both report creators and decision-makers.

Let’s explore how manual reporting holds you back and how automated reporting can transform your financial processes.

Manual Reports Limit Decision-Making Ability

Management reporting plays a critical role in assessing business performance and aligning strategies with long-term goals. Yet, manual reporting often creates roadblocks that prevent timely and effective decision-making.

The primary purpose of management reporting is to deliver actionable insights that guide leadership in making data-driven decisions. However, manual processes inherently slow down this feedback loop, undermining the entire decision-making framework.

Manual Reporting Prioritizes Data Validation Over Analytics

Manual reporting heavily leans on tools like Excel for data manipulation and PowerPoint for presentation. This requires several layers of manual data input and review. Unfortunately, this shifts focus from extracting insights to simply verifying raw data.

Key challenges include:

- Multiple Rounds of Validation: Before reports are finalized, teams must validate data accuracy, verify formulas, and ensure consistent formatting.

- Disjointed Processes: Switching between different tools like Excel, PowerPoint, and accounting software increases the complexity of validation.

Ultimately, this leaves management overwhelmed with validation tasks instead of actionable analytics, diluting the value of the reports.

Manual Reporting Consumes Excessive Resources

Manual reporting requires a significant investment of time, personnel, and infrastructure. Finance teams often juggle multiple platforms for data extraction, manipulation, and presentation. This fragmentation leads to inefficiencies such as:

- Increased Staffing Needs: Extra hands are required to input and cross-check data, stretching budgets unnecessarily.

- Inefficient Systems: The use of separate tools for different stages of reporting creates redundancy and slows down the workflow.

Moreover, these inefficiencies aren’t just monetary—they also result in missed opportunities for deeper analysis.

Manual Reporting Wastes Time

Time is a critical factor in decision-making, and manual reporting is a significant time drain. The process of compiling, formatting, and validating reports is often tedious and repetitive.

Specific time-wasting tasks include:

- Adjusting visual elements like graphs, tables, and layouts for presentation.

- Double-checking formulas and ensuring data consistency.

- Reconciling errors caused by miscommunications or outdated links.

This delays the delivery of critical insights to decision-makers, often leading to suboptimal outcomes.

Automated Reporting: The Smarter Alternative

The limitations of manual reporting underscore the need for automation. Automated reporting tools eliminate inefficiencies, improve accuracy, and allow teams to focus on high-value activities like strategy and analysis.

Benefits of Automated Reporting

- Minimized ErrorsAutomation drastically reduces errors caused by manual data entry and formula mishaps. It ensures:

- Consistent data integrity.

- Real-time updates that eliminate version control issues.

- Built-in error checks that catch discrepancies early.

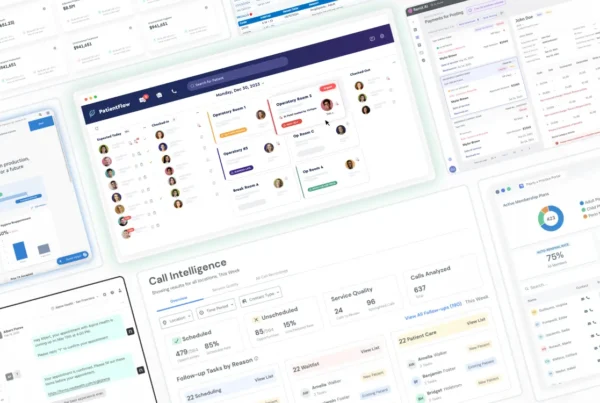

- Enhanced Visual DashboardsAutomated tools offer dynamic dashboards that present real-time data in an easy-to-digest format. This eliminates the need for manual visualizations and ensures:

- Better readability for stakeholders.

- Customizable views tailored to specific needs.

- Instant updates to reflect changing metrics.

- Faster TurnaroundBy automating repetitive tasks like data compilation and formatting, these tools free up time for meaningful analysis. Finance teams can now:

- Deliver insights faster.

- Respond quickly to emerging trends.

- Allocate resources more effectively.

Automated Reporting vs. Manual Reporting

The contrast between manual and automated reporting is stark. Automated tools not only reduce errors and resource use but also enable faster, more accurate decision-making.

Features of Automated Reporting:

- Scheduled Reports: Automated systems can generate and distribute reports at predefined intervals, ensuring timely access to information.

- Interactive Dashboards: Users can drill down into specific data points or generate custom queries without needing to rely on finance teams.

- Data Accessibility: Automated systems integrate with multiple data sources, creating a centralized repository for all reporting needs.

These features empower organizations to operate more efficiently, giving them a competitive edge in fast-moving markets.

Using a Comprehensive Reporting Solution

Modern reporting solutions, such as Microsoft Power BI, Tableau, or Zoho Analytics, are transforming how businesses manage their data. These tools integrate seamlessly with existing systems, providing real-time updates and robust reporting capabilities.

How Advanced Reporting Tools Transform Processes:

- Real-Time Data Integration: Connect to multiple data sources for instant updates, eliminating the need for manual adjustments.

- Streamlined Forecasting: Automated tools make budgeting and cash flow forecasting more accurate, helping organizations align their strategies with real-world performance.

- Error Prevention: Built-in safeguards prevent common errors like stale links, broken formulas, or version control problems.

These tools also support customizable dashboards, enabling businesses to visualize data in ways that make the most sense for their unique goals.

Final Thoughts

Manual reporting is no longer suitable for the demands of modern business. Its inefficiencies, inaccuracies, and resource-intensive nature hinder growth and decision-making.

By adopting automated reporting solutions like Microsoft Power BI or Tableau, organizations can unlock their full potential, reduce risks, and focus on delivering strategic value. Embrace automation and revolutionize your financial reporting today!