In the financial sector, KYC verification with AI technology is more than just a buzzword—it’s essential for preventing money laundering and other financial crimes. Staying competitive today requires leveraging the latest technology to enhance these processes.

KYC, or Know Your Customer, is fundamental for due diligence and regulatory compliance. It enables financial institutions to verify customer identities and prevent illegal activities. By knowing exactly who they’re dealing with, businesses can create safer environments and prevent fraud.

KYC verification with AI technology extends beyond banks and financial institutions, safeguarding against identity theft, criminal activities, and unauthorized transactions across sectors handling customer funds or sensitive data.

This guide demonstrates how to adopt AI technology in KYC processes to enhance security, efficiency, and customer satisfaction.

Manual (Traditional) KYC Verification

Traditional, manual KYC verification relies heavily on human input. While this method allows for personalized handling of complex cases, it can be time-intensive and susceptible to human error, which accounts for around 74% of breaches.

Steps in manual KYC typically include document collection, validation, and customer interaction, often involving interviews to confirm identity details. Finally, a decision is made based on collected data to either approve or deny onboarding.

Automated KYC Verification with AI Technology

As the global user base for digital banking approaches one billion by 2024, automated KYC verification with AI technology is shifting from an optional enhancement to an industry necessity. This surge in online banking, particularly in regions like Europe and South Korea, highlights the need for swift and reliable digital identity verifications.

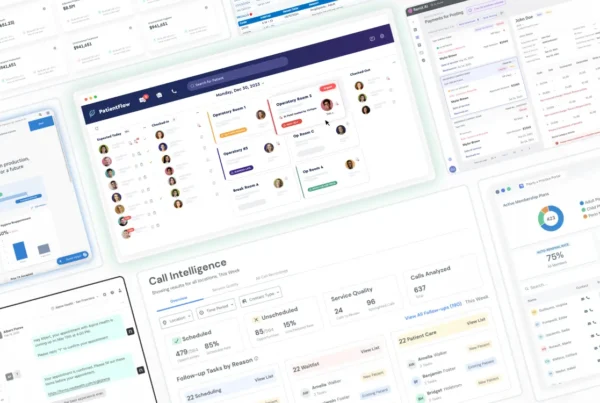

AI-powered KYC solutions address scaling demands efficiently, providing the speed and accuracy required for today’s banking expectations. Here’s how it all works:

Key Components of Automated KYC with AI

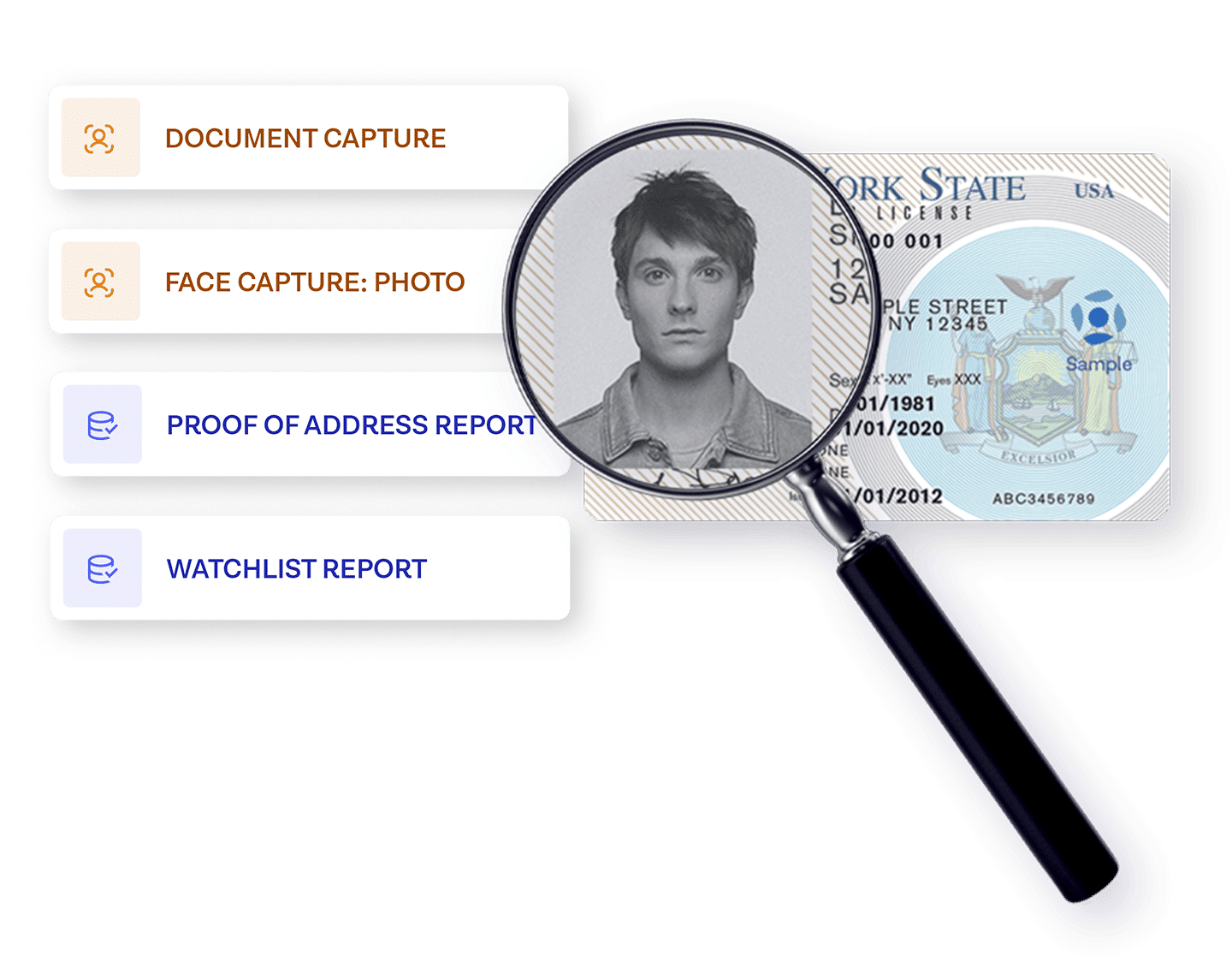

Automated KYC verification with AI technology incorporates several essential components:

- Document Scanning and RecognitionAI tools, such as BlinkID, can instantly recognize, read, and verify thousands of identity documents worldwide.

- Data Analytics and Risk AssessmentExtracted document data is cross-referenced with watchlists, politically exposed persons (PEP) lists, and fraud databases to assess customer risk.

- Pros and ConsWhile automated KYC delivers speed, accuracy, and scalability, it may lack the flexibility to handle unique cases as manually. However, advancements in AI and machine learning continue to close this gap.

Manual vs. Automated KYC

Choosing between manual and automated KYC verification is crucial in the digital age, as each method has distinct benefits and limitations. Here’s how they compare:

- Efficiency and SpeedManual KYC is time-intensive and often involves physical document checks. Automated KYC verification with AI technology, on the other hand, completes these processes in seconds, enabling real-time results.

- Accuracy and Error RatesManual processes are prone to errors, which can compromise the verification program. Automated KYC, driven by AI, reduces these errors by recognizing and validating documents with greater accuracy.

- Cost-EffectivenessManual verification is labor-intensive, often requiring substantial paperwork and employee hours. Automated KYC reduces these costs by streamlining identity verification, making it more economical.

- ScalabilityManual KYC is limited by human capacity, whereas automated solutions can handle larger, more complex data sets accurately, making it easier to scale.

- Customer ExperienceAutomated KYC verification offers a fast, seamless experience, enhancing customer satisfaction and loyalty.

- Compliance and Regulatory ConsiderationsAI-powered KYC systems streamline regulatory compliance by adopting document-centric approaches that ensure consistent, accurate identity verification.

Benefits of KYC Verification with AI Technology

The rise of digital banks, expected to reach a market of $2 trillion by 2030, wouldn’t be possible without the support of AI. KYC verification with AI technology provides numerous benefits:

- Verification EfficiencyAI tools like Microblink accelerate the identity verification process, making it both faster and more accurate, reducing the chance of human error.

- Overall Cost ReductionBy automating KYC verification, companies reduce manual labor, leading to substantial savings and improved efficiency.

- Enhanced Customer ExperienceSolutions such as BlinkID offer users a smooth onboarding experience, available on demand, while maintaining security.

- Increased Security and ComplianceAI-enabled tools identify fraud and false documents early in the process, improving overall security and compliance.

- Valuable Data and InsightsAI solutions capture and analyze data, offering insights that enhance loyalty programs and customer value.

Company-wide KYC Best Practices to Implement

To stay compliant and secure, here are five best practices for KYC verification with AI technology:

- Strict Customer Identification StandardsUse independent, reliable data sources to verify customer information accurately.

- Customer Due Diligence (CDD)Understand and monitor each customer relationship, regularly updating information.

- Risk-Based ApproachAssess each customer’s risk and adapt KYC procedures based on their risk level.

- Meticulous DocumentationKeep thorough records of all KYC procedures, check results, risks, and actions taken.

- Staff TrainingRegularly train staff on KYC procedures, regulations, and red flags to enhance security.

Key Takeaways

KYC compliance is fundamental for preventing financial crimes and managing regulatory obligations. Although manual KYC processes are often prone to errors, automated KYC verification with AI technology offers a seamless, secure, and efficient alternative.

Future Outlook for KYC Processes

The future of KYC verification lies in AI advancements, digital identity verification, and biometrics. With evolving regulatory requirements, businesses will increasingly rely on AI solutions to stay compliant and safeguard against financial crimes.

How UnoiaTech Can Help

UnoiaTech is leading the way in AI-driven KYC verification technology, offering solutions that seamlessly integrate into any identity verification workflow. These advanced tools not only support businesses in meeting KYC compliance standards but also significantly improve the customer experience by making verification processes fast and straightforward.

Through a document-centric approach, UnoiaTech enables businesses to detect fraudulent documents early, reducing fraud risk by over 50%. With its robust capacity to handle large volumes of complex data, UnoiaTech empowers businesses to scale efficiently and stay competitive in a rapidly evolving market.